On January 28th, 2025, President Donald Trump issued an executive order to freeze federal funding across multiple programs, including education. This move was part of Project 2025, a broader initiative aiming to reduce federal oversight in education, potentially leading to the elimination of the Department of Education. However, a federal judge, named John McConnell, temporarily blocked this action, igniting widespread discussion on its implications, especially for students who rely on federal financial aid.

The Free Application for Federal Student Aid, also known as FAFSA, is a crucial resource for millions of high school and college students seeking grants, loans, and work-study opportunities. The blockage of the funding freeze provides temporary relief, but the uncertainty surrounding Project 2025 raises concerns about the future of financial aid and education funding in the United States.

Trump’s funding freeze is aimed to halt federal grants and loans in an effort to reduce government spending. However, this decision faced immediate legal challenges from multiple states, including California, which argued that the move overstepped executive authority.

In total, 22 states filed a lawsuit against President Trump and his administration in response to the funding freeze. States including Arizona, California, Colorado, Connecticut, Delaware, New Jersey, New Mexico, New York, Oregon, Rhode Island and 12 others states joined the legal battle. They claimed that the freeze violated the separation of powers by allowing the executive branch to alter congressional spending unilaterally.

Judge John McConnell, a federal judge in Rhode Island, ultimately ruled that the freeze violated the separation of powers, as the executive branch cannot independently alter congressional spending. Consequently, the judge temporarily blocked the freeze, allowing federal funds to continue flowing to essential programs, including those in education.

FAFSA serves as the primary source for students seeking financial support for higher education. If the funding freeze had gone into effect, it could have delayed or reduced access to Pell Grants, federal student loans, and work study programs.

Project 2025 proposes eliminating the Department of Education, which raises questions about the administration of Federal Financial Aid. Without a centralized federal body overseeing FAFSA, students could face delays, inconsistencies, and disparities in aid distribution.

Educational Institutions are closely monitoring these developments, as changes in federal funding could have significant consequences for school budgets. Title 1 funding, which supports schools with higher numbers of low income students, is particularly at risk under Project 2025’s proposals.

The elimination of Title 1 funding could lead to the loss of over 180,000 teaching positions, affecting nearly 2.8 million students nationwide.

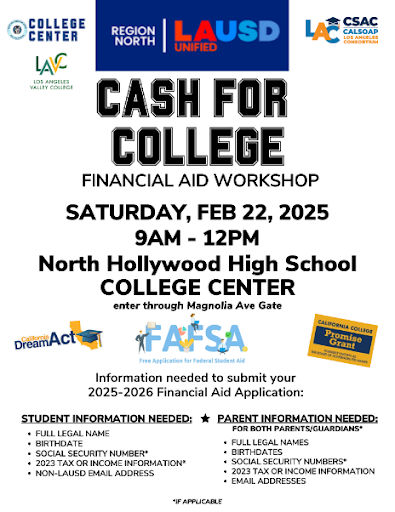

High school seniors are now particularly concerned about how these changes might affect their ability to afford college. Many are now considering alternative funding sources, including state-based scholarships, private grants, and personal loans, to ensure they can pursue higher education despite uncertainties surrounding FAFSA.

Some schools are exploring alternative funding sources, such as state grants and private donations, to mitigate potential losses. Administrations are also working on strategies to communicate these potential changes to students and parents. College center counselors have reported an increase in student and parent concerns and questions about financial aid.

When asked if there had been an increase in student and parent concern from North Hollywood High School families, college counselor Ms. Valle states, “Even before sort of that news around the [funding] freeze, the concerns were our mixed status families, so either our undocumented students or students whose parents are undocumented.”

College advisors are emphasizing financial literacy, encouraging students to seek out multiple funding options, and staying updated on potential policy changes.

“So the big risks right now are all with the federal government. So the other alternative that we talk about with students and parents [would be], California Student Aid Commission, California Dream Act, Pell grant, we’re pretty lucky in this state,” Ms. Valle continued.

The California student aid commissions, as Ms. Valle explained, oversees all cal grants, so all of the money comes from the state as well as the information being more secure as it only is available to the state.

While the court’s blockage of the funding freeze temporarily preserves federal student aid programs, the broader goals of Project 2025 continue to pose uncertainties for students and educators. The potential dismantling and elimination of the Department of Education and Title 1 funding could reshape the landscape of financial aid and educational equality in the United States.

Despite the growing concerns among students and families, students and staff feel as though the news surrounding the funding freeze has not been sufficiently distributed to the broader public.

Jayleen Moreno, a senior at North Hollywood High School mentions, “I wasn’t quite fully aware of the situation…I would like to know if there is a certain plan or if there’s people that will be excluded from financial aid, or if things will just be taken away or completely will be taken away like it will no longer exist.”

Many feel that the coverage of the issue has been insufficient, and there is a need for more targeted information campaigns to help parents. Expanding outreach through multiple languages and platforms could play a crucial role in ensuring that families are fully aware of how the freeze might affect or be affecting access to financial aid.

High school seniors are particularly concerned about how these changes might affect their ability to afford college. Many are now considering alternative funding sources, including state-based scholarships, private grants, and personal loans, to ensure they can pursue higher education despite uncertainties surrounding FAFSA.

As these discussions continue, students, parents, and educators must all remain informed and engaged. The future of education and FAFSA are still uncertain but it can be fought for and changed.